Ga State Income Tax Rate 2025. The $1,650,000 difference (between the. Georgia individual income tax returns must be received or postmarked by the april 15, 2025 due date.

If the proposal is approved, the tax rate for 2025 would be 5.39%. Georgia offers tax breaks for retirement income and there are no estate or inheritance taxes in.

Qmb Limits 2025, With early balloting underway, voters are deciding on a state constitutional amendment that would limit valuation increases for property tax purposes to the yearly rate of.

Ga State Tax Rate 2025 Winny Kariotta, This year, 2025, georgia moved to a flat personal income tax rate of 5.49%.

.png)

Tax Rates 2025 Traci Harmonie, This year, 2025, georgia moved to a flat personal income tax rate of 5.49%.

State Tax Rate 2025 Averil Devondra, Quarterly estimated income tax payments normally due on january 15 and april 15, 2025.

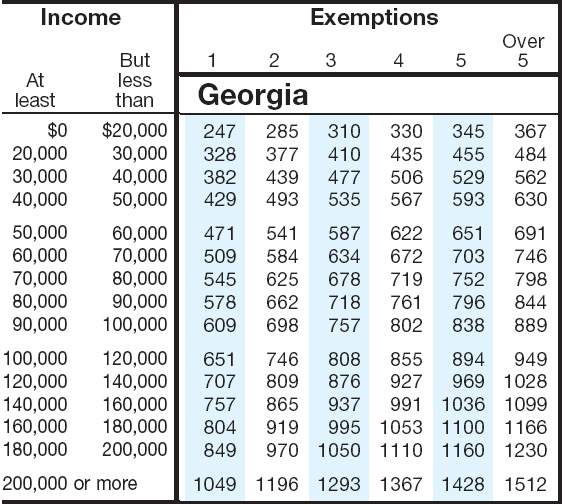

2025 Taxable Brackets And Rates By Industry Lacie Miquela, Understanding your georgia income taxes.

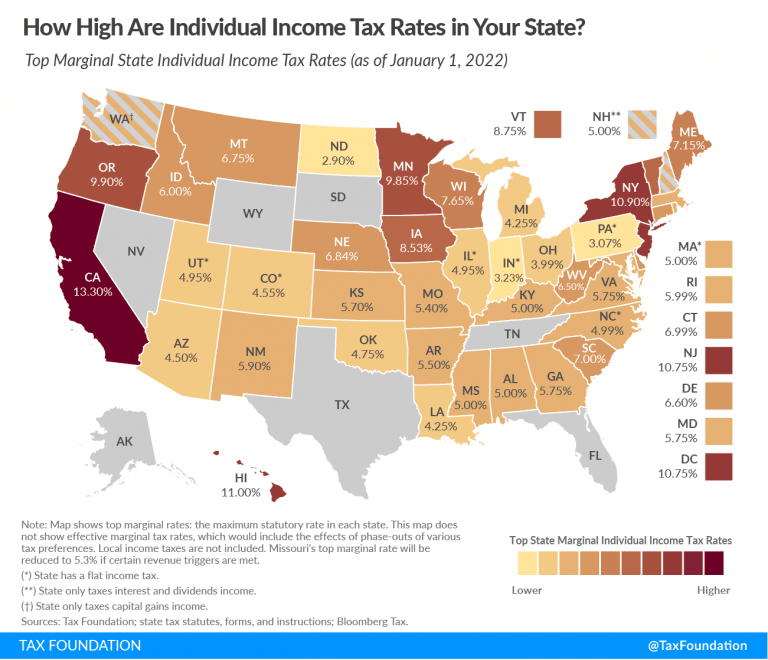

2025 State Tax Rates and Brackets, In 2025, the state transitioned from a bracket system to a flat tax rate of 5.49%.

State Tax 2025 2025, Rates range from 1% on the first $750 of taxable income for single filers ($1,000.